Discover credit card is suitable for those who have just obtained SSN and have zero credit history to apply. I just came to the United States to apply for the “God Card” in the first entry card, and the cashback% is very good. It is very suitable for people who have just gotten SSN at work, or as TA or RA in school!

This is also the first card I applied for when I was just working. The cash rewards for the first year will be doubled. Applying online is fast and convenient. I have sorted it out in the article, tips to maximize your feedback!

It is highly recommended that you just work or get a SSN card that you can apply for, it is the best card for novices! And almost every online shopping can be used!

If you still don’t know what credit scores and credit records are, you can refer to this article: Can international students also apply for credit cards? 4 credit cards suitable for international students

Contents

Application link & sign-up bonus

Application link

This is an online application, Discover it application link (after the application completes the first purchase, there will be a USD 50 card opening gift)

Card opening bonus: USD50

After you apply, you will receive a USD50 card opening gift after completing the first purchase.

Application conditions

When you have an SSN, you can apply when you have your address. International students and visiting scholars can apply for SSN. You can go to the school to ask and you can apply.

Online application is very convenient and there is no annual fee.

advantage

Advantage 1. You can apply as soon as you get the SSN

Many credit cards, such as some Chase cards, hope that you have accumulated a certain credit history before you can apply.

However, this card does not require a credit record. You can apply for it only with an SSN. It is very suitable for people who have just obtained an SSN at work, or as a TA or RA in school.

Advantage 2: Double cash back in the first year

In the first year, I will match the accumulated cash rewards. I will accumulate all the rewards this year, and I will give back to you at the beginning of the second year.

Example: If in the first year, all accumulated rewards are USD 150, in the second year, at the beginning, Discover it will give me USD 150 again.

Advantage three, quarterly cash back 5 times (5%)

- 5% feedback : different types every season

- 1-March: Supermarket, Walgreens, CVS

- April-June: Come on, Uber, Lyft, Wholesale Clubs

- July-September: Restaurants, PayPal

- October-December: Amazon , Walmart, Target

- 1% feedback : other types of consumption

3.1 Tips to maximize your feedback

In Amazon quarterly, the maximum reward per quarter is USD1500, and you can purchase Amazon Gift Cards for USD 100 * 15.

- Maximize the use of USD1500 cap

- The cash rebate for the first year will be Matched, which means USD 75 + USD75 rebate

- Amazon usually uses it, and it can be accumulated in advance

- Buy USD100 denomination, because you can exchange it with your friend or give it to your friend.

- Amazon Gift Card can also be used to purchase gift cards from other merchants :

- Uber, Whole Foods, Sephora, Nordstrom, Starbucks

- Netflix, Airbnb , Hotels.com, Fandango, Seamless , Doordash

- Chipotle, Dominos, Forever 21, Old Navy, Nike, JCPenney, Southwest Airline

Advantage 4: No handling fee for overseas card swiping

There is no handling fee for overseas consumption. If you swipe your card outside the United States, there will be no handling fee. It is very suitable for people who love to travel or go home to play.

Normally, credit cards will charge a foreign transaction fee of 1%-3% across countries. However, if you use Discover IT overseas, you can avoid this fee. It is very suitable for international students and people who love to travel.

Advantage 5, provide free credit history report

After applying for the Discover it card, he will provide free real-time FICO score report, which means that FICO scores will change over time.

Length of Credit: I just held a Credit Card in my first year, and this indicator was all Low. It was about the second year that I held a credit record before I arrived at Fair.

How long does it take to accumulate the first credit report? Ans: You need to hold the card for normal consumption and repayment for 3-6 months.

It is recommended that the earlier you accumulate credit history, the credit history will improve over time (time accounts for 15% of the record score)

Advantage six, recommend friends, reward USD50

When you apply for this card, you can share your link to your friends. If your friends apply successfully, you can get USD50.

The upper limit of the whole year is USD 500/Calendar Year, which means you can recommend to ten friends a year.

Advantage seven, reward for good students: USD20/ year

If you are running the Discover IT Student version, as long as the GPA is higher than 3.0 per year, you can get USD20 for up to 5 years.

It is very suitable for people who come to study for bachelor’s, master’s and doctoral degrees.

Advantage eight, no annual fee

For the entry card, the 0-year fee is very important. If you apply for another card later, you don’t have to worry about this card. Let this card continue to grow older (help your FICO score get better).

Advantage nine, a variety of card design options

My first one was the cover of New York. Many big cities have their own card covers! Come and find out if there is a cover you like! 😀

shortcoming

Disadvantage 1. Quarterly cash rebate, consumption limit is USD1500

The consumption limit for each quarter is USD1500, and the excess amount is calculated with 1%.

Example: If you spend USD2000 in the current season’s category, USD1500, you can get USD75 back, and the remaining USD500 is calculated with 1%, that is, USD5, and a total of USD80 is given back.

Disadvantage two, the initial quota is low

Because it is an entry card, the initial limit is not too high. If it is a student version, it may fall at USD500.

Disadvantage three, the popularity rate of using stores is less than Visa and Mastercard

The penetration rate of Discover card is relatively less than that of Visa and Mastercard, so before using it, remember to check whether the merchant has attached Discover credit card stickers.

But in most large cities, Discover IT credit cards can be used painlessly.

4 ways to redeem cash back

Method 1: remit to bank account

It can be linked to your bank account, and it will go to your bank account.

Method 2: Use on Amazon

You can use the accumulated cash back at Amazon checkout.

Method three, use on PayPal

Or you can tie your credit card to PayPal, and when you use PayPal to make purchases, you can use your accumulated cash back by the way.

Tip : In the third quarter, PayPal’s feedback was 5%. Remember to connect your card to PayPal. You can use PayPal to check out many things.

Method 4: Change to Gift Card (Usually there will be additional discounts)

There are many common businesses such as Hotel.com, Groupon, iTunes, Nike, Nordstrom, Old Navy, Starbucks.

They are divided into 9 categories:

- Dinning room

- houseware

- Popularity

- Department store

- entertainment

- Health Care

- Sports & Entertainment

- gift

- travel

Who is the Discover credit card suitable for?

- People who have just received SSN and have not accumulated credit history

- The first credit card, accumulating credit card

I just worked myself, and the first card I applied for was this card.

Application notes

- You can apply with zero credit history (just got the SSN)

- Already hold a Discover card and must hold it for more than one year before applying for the second one

- Discover cap application, two Discover cards

My experience sharing

When I first started working, when I got the SSN, the first card I applied for was the Discover IT card. I like him every quarter, except for the season of refueling.

There will be cash back in the second year. Match, the cash back I accumulated throughout the first year is about USD300, which is really good. But after the second year, I used this card in fewer physical stores, mainly tied to PayPal or used by Amazon.

This is really an entry-level card. The rewards are higher than other entry-level cards, and there is no annual fee. It is also very convenient to apply, just apply online.

Apply for Discover IT credit card teaching: 3 steps

Step 1: Click Discover IT

Note: If you need to use this Discover IT link to apply, you will get a card opening gift of USD50, and you will not get a direct application on the official website! ! !

Step 2: Fill in the basic information and choose the cover of the card

Fill in the basic personal information and choose the color of the card.

Notice:

- Address: Need to be a US address

- Phone number: U.S. phone

- Birthday format: month/day/year

- Occupation: You can fill in the case at the current job, and students can fill in students.

- Nationality: choose your nationality

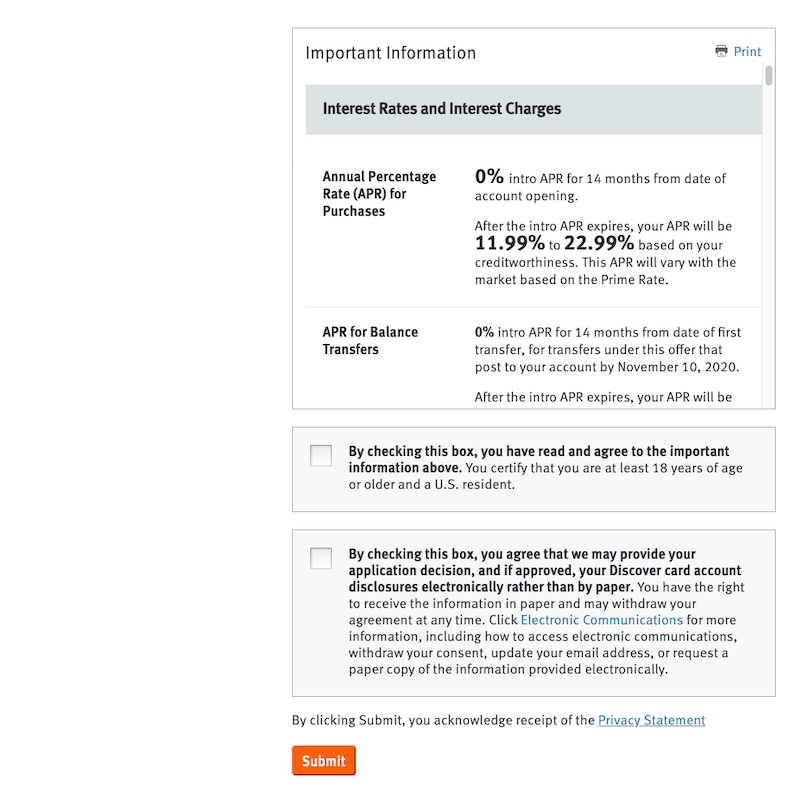

Step 3: Read important information and submit application

Read relevant important information, tick, send, and you are done!

Reader FAQ Q&A

Q1. How long does it take to get the sign-up bonus?

Usually one to two months, you will see it in your account.

Q2. What is the difference between the normal version and the student version?

1. The quota is different: the quota of the regular version is a little higher than that of the student version

2. Good student award: only available in the student version, eligible, you can get USD20 every year

Q3. How do I know the result of the application immediately?

Suggestions can be directly called to the customer service, he will tell you directly. (But it’s usually good, don’t worry)

You can also check the status of your Discover ® Card Application from here to check the progress of your application.

Q4. In the US, if there is no SSN, how can I start accumulating credit history?

For international students who have just landed, how can they start accumulating credit history? The two most common methods are:

1. Apply for Deserve Edu (SSN is not required): International students, generally do not have an SSN when they first arrive in the United States. How to apply is described below.

2. Authorized account : relatives in the United States who have a Credit Card can add you as an authorized account. This is the easiest and fastest way.

Extended reading: [Study Abroad Credit Card] Deserve Edu credit card, no SSN, easy application in 3 steps

For the new arrival without SSN, I personally recommend applying for Deserve Edu first . You can apply directly on the Internet. After passing, you will receive it in about a week, and you will be given Amazon Prime Student for one year.

Q4. What is a credit score?

The credit score is between 300-850, and usually more than 700, it will be regarded as an indicator of good credit!

| Fraction | Ranking | Representative meaning |

| <580 | Poor | Far below the average American consumer, who is at high risk for borrowing |

| 580 – 669 | Fair | Below the average American consumer, many lenders (Lender) are willing to lend to you |

| 670 – 739 | Good | Close to and slightly above average, most borrowers (Lender) will be regarded as those with good credit |

| 740 – 799 | Very Good | Above average, the borrower thinks you are a fairly reliable person |

| 800 + | Exceptional | Much higher than average, lenders feel that lending to you is low risk |

Take FICO as an example

Usually at least 6 months of accumulated credit history will have a corresponding report.

Q5. What are the indicators of credit scores?

Most of the three major credit record institutions in the United States use the following five indicators to measure the borrowing risk of borrowers.

| index | Proportion |

| Payment history | 35% |

| Amount you owe | 30% |

| Length of credit history | 15% |

| New credit opened | 10% |

| Types of credit you have | 10% |

After applying for the Discover it card, he will provide free real-time FICO score report, which means that FICO scores will change over time.

Length of Credit: I just held a Credit Card in my first year, and this indicator was all Low. It was about the second year that I held a credit record before I arrived at Fair.

in conclusion

This card is very suitable for the first application of SSN when you just came to the United States and do not have a credit history. It is the “God Card” in the entry card, and the cash rewards are high.

In addition to earning rewards, if you want to start buying US stocks and ETFs, what kind of protection should you use?

Extended reading: [Account Opening Teaching] Firstrade, an American brokerage firm, 5 minutes easy account opening teaching

Further reading: Can international students also apply for credit cards? 4 credit cards suitable for international students