Last Modified 2022年7月8日

Which US bank I should choose? With the beginning of the US school season, you are also ready to start your study abroad life.

In addition to renting a house, applying for a visa, and applying for a mobile phone, you need to open an account with a US bank after you settle down in your place of residence, and put the huge sum of money in your body in a safe place ( Is anyone still using traveler’s checks? ), you can also open up the golden road between your hometown and the United States. If I want to buy U.S. stock ETFs, what kind of account do I need to open?

How to send money from home to the United States? Which US bank is right for me? What should I do if I transfer money to my friends across banks?

What information do I need to prepare for opening an account? After opening an account, which credit card is recommended to start accumulating credit records in the United States?

The above are all the problems that I have just arrived in the United States. This is the article I have compiled to solve the above problems! Hope it helps you!

I also went through this process at the beginning and wanted to organize these notes.

- What documents do I need to bring to open an account

- Which bank is right for you?

- How do I wire my living expenses from my hometown?

- I want to buy U.S. stocks and ETFs, what kind of account do I need to open?

I hope this article can help you quickly manage the US bank, stabilize your life, and start studying abroad and working life. After opening a U.S. bank account, you can quickly apply for the first credit card, accumulate credit records in the U.S., normal consumption, bill payment, about 3-6 months, there will be the first credit record report!

Read more: [Study Abroad Credit Card] Deserve Edu credit card, no SSN, easy online application in 3 steps

Priorities to do when entering the U.S.:

“Visualization Overview” Guide to Study Abroad

- Buying air tickets : [U.S. Travel] How do I buy air tickets in the United States? 3 steps to buy cheap air tickets

- Report to school

- Looking for a long-term rental house :

- [US Rental Housing] How to find a suitable place to live? 6 common steps to rent a house

- [New York rentals] Where is the safest in New York? Rent budget? 4 areas where international students in New York live

- [American Life] Purchase of American furniture, 3 sources of furniture, 10 commonly used furniture

- Open a bank account :

- Phone number

- Temporary sim card : 14 to 30 days temporarily, you can report safety to your family after landing

- [Recommendation] (people outside US) directly use e-sim card, open online before departure, and use the Internet directly when landing: Mint Telecom

- Long-term use of telecommunications providers

- I currently use Mint for 4G data per month for $15 per month (you can apply online and send it home)

- [US Telecom] Save Mint Mobile, $15 per month, 5 easy steps to apply online

- Temporary sim card : 14 to 30 days temporarily, you can report safety to your family after landing

- Apply for a credit card (start to accumulate credit records):

- My website for studying abroad

- U.S. Medical Insurance :

- U.S. stock ETF investment account opening: [Account opening teaching] Firstrade, an American brokerage firm, a 5-minute easy account opening tutorial

- Changing your driver’s license: [Study in the US] Taiwan’s driver’s license is exempted from the test and the US driver’s license is easily changed in 33 states

Contents

1. 4 required information to open an account(US Bank)

- passport

- Second ID (English name is required): student ID, or driver’s license (some banks will require dual IDs)

- I20 (Students and the Form I-20)

- Personal contact information

- U.S. address

- Phone number (Optional)

US phone number

If your mobile phone supports e-sim, you can apply online in advance in Mint , and you can apply for it before going abroad, and you can use it immediately. You will have a mobile phone number when you land, and you can go directly to the bank to open an account.

You can refer to this article. I recommend it myself, and many readers have responded very well. It is very suitable for people who have just come to the United States to apply. It is convenient and fast!

You can refer to: [US Telecom] Save money on Mint Mobile, $15 per month, 5 easy steps to apply online

2. 2 common account types

There is no paper passbook for opening an account in the United States. Usually, the following three methods are used to check the balance and daily consumption

- ATM

- Online banking

- Bank App

In the United States, checks are still used daily. For example, some landlords tend to accept checks, so when opening a Checking Account, the US bank will provide a few checks to use, and then you can order them with the bank yourself.

2.1 Checking Account:

- Function: dedicated account for daily expenses, withdrawing money, writing checks

- Interest: No interest

- ATM withdrawal: you can withdraw, and there is no limit on the number of times a month

2.2 Saving Account:

- Function: current deposit account

- Interest: There is interest

- ATM withdrawals: withdrawals are possible, but there is a limit on the number of times per month

3. 4 common keywords for opening an account

3.1 Debit Card ATM/Cash Card

When you apply for a Checking Account, you will be provided with a Debit Card connected to this account to provide withdrawals, similar to a financial card.

Read More: [Study Abroad Credit Card] Deserve Edu credit card, no SSN, easy application in 3 steps

3.2 Direct Deposit

There are usually four types

- Payroll

- Social Security

- Pension

- Government benefits

It will be regarded as Direct Deposit, and general bank transfer is not regarded as Direct Deposit.

3.3 International Wire Transfer

International transfer method

3.4 Annual Percentage Yield (APY)

The interest rate for a full year of deposit.

4. The 4 major banks in the U.S.(US bank)

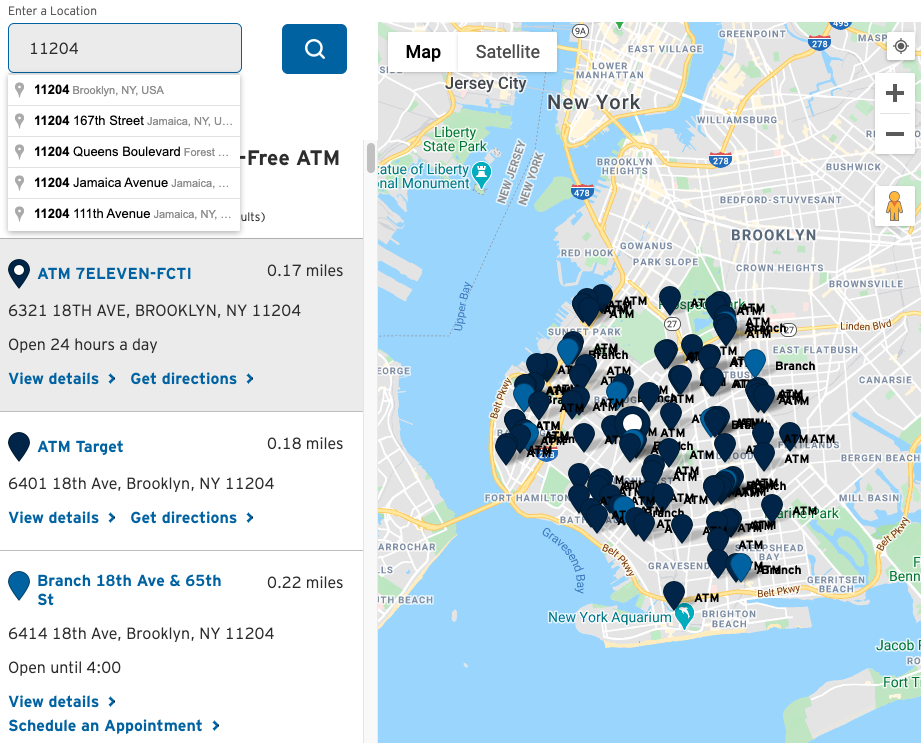

4.0 How to Query Service Locations

| Bank around you | |

| Chase Bank | Find Chase around you |

| Bank of America | BoA around you |

| Citi Bank | Citi around you |

| Wells Fargo | Wells Fargo around you |

Search for the number of service locations near your life. I have attached the query method of each bank, so that you can quickly find the bank that suits you. The service locations above can be inquired according to the Zip code or address of your residence.

When applying for a bank for the first time, it is recommended to apply for a bank with many service bases nearby. In life, it is much more convenient to withdraw money and do banking-related matters.

4.1 Chase Bank

One of the most common banks in New York, you can see Chase at almost every corner.

Chase Total Checking Account

- Account opening deposit: USD 25

- Other bank ATM withdrawal fees:

- Within the United States: USD 2.5

- Outside the United States: USD 5

- Account management fee: US12/month

- 3 ways to waive account management fees: just meet one of them

- Direct Deposits USD 500 at least once a month

- Maintain at least USD 1500 deposit every day

- The linked deposit or investment account has USD 5000

The account opening bonus is USD200 if it meets the eligibility for online account opening.

Chase College Checking

Conditions: As long as they are 17-24 years old, students who have presented a certificate of enrollment can apply. (Up to five years)

When I landed to open an account, I just passed the age threshold (Can Nian)

- Account opening deposit: USD 25

- Other bank ATM withdrawal fees:

- Within the United States: USD 2.5

- Outside the United States: USD 5

- Account management fee: US6/month

- 2 ways to waive account management fees: just meet one of them

- Direct Deposits at least once a month

- Maintain at least USD 5000 deposit every day

Saving Account

- Account opening deposit: USD 25

- Monthly withdrawal times: 6 times/month, after exceeding, USD 5/time

- Account management fee: USD 5/month

- 3 ways to waive account management fees: (satisfy one of them)

- Maintain a deposit of at least USD 300 every day

- Transfer at least USD 25 from the linked Checking Account to this account

- There is an investment account linked to Chase

4.2 Bank of America

Checking Account

- Account opening deposit: USD 25

- Other bank ATM withdrawal fees:

- Within the United States: USD 2.5

- Outside the United States: USD 5

- Account management fee: US12/month

- 2 ways to waive account management fees: just meet one of them

- Direct Deposits USD 250 at least once a month

- Maintain at least USD 1500 deposit every day

When opening an account, you can also ask Banker to help you get a Bank of America® Cash Rewards Credit Card. You can also apply without SSN. Although the amount is not high at the beginning, you can start to accumulate your credit history.

Further reading: [Study in the US] Can international students also apply for credit cards? 2 credit cards suitable for international students

Saving Account

- Account opening deposit: USD 100

- Monthly withdrawal times: 6 times/month, after exceeding, USD 10/time

- Account management fee: US8/month

- 3 ways to waive account management fees: (BOA Saving waives account management fees )

- Maintain a deposit of at least USD 500 every day

- From the linked interest checking Account

- Become a Preferred Rewards member

4.3 Citi Bank

Checking Account

- Account opening deposit: USD 0

- Other bank ATM withdrawal fees:

- Within the United States: USD 2.5

- Outside the United States: USD 5

- Account management fee: US12/month

- 3 ways to waive account management fees: just meet one of them

- Direct Deposit at least once a month “At the same time” use the account to pay the bill once (mobile phone, water and electricity…)

- Maintain USD 1500 or more every day

- Account holder over 62 years old

Saving Account

- Account opening deposit: US 100

- Account management fee: US25/month

- 3 ways to waive account management fees: just meet one of them

- Direct Deposit at least once a month “At the same time” use the account to pay the bill once (mobile phone, water and electricity…)

- Maintain USD 1500 or more every day

- Account holder over 62 years old

The account opening bonus is USD200, USD500, USD700. If you are eligible for online account opening, you can have different account opening amounts based on the amount you deposit.

Note: If you don’t have the social security code SSN, you cannot open an account online. You have to do it at the counter. You can take the opportunity to open a Citibank account when you travel to the United States. Take New York as an example. Many Citibank ( Citibank Canal St ). I do it here. There is a Chinese-speaking staff, and I am not afraid of missing details when communicating in Chinese.

4.4 Wells Fargo

Checking Account

- Account opening deposit: USD 25

- Other bank ATM withdrawal fees:

- Within the United States: USD 2.5

- Outside the United States: USD 5

- Account management fee: US10/month

- 3 ways to waive account management fees: just meet one of them

- Direct Deposit USD 500 or more at least once a month

- Maintain USD 1500 or more every day

- Use Debit Card more than 10 times

- Account owner 17-24 years old

Saving Account

- Account opening deposit: USD 25

- Account management fee: US 5/month

- 3 ways to waive account management fees: just meet one of them

- Maintain a deposit of at least USD 300 every day

- Transfer at least USD 25 from Checking Account to this account every month

- Account owner, under the age of 18

5. U.S. Investment Brokers

Firstrade

Whether you want to invest in US stocks and overseas global ETFs in Taiwan, or you want to invest in US stocks and ETFs in the US, Firstrade is one of the very good US brokers.

In addition to the full Chinese operation interface and 24-hour Chinese and English customer service, many stocks and ETFs are free of transaction fees, and account opening does not require any account opening fees, and you can easily open an account as long as you are online!

Easy account opening in 3 minutes online

6. The 3 steps of the US bank account opening process

6.1 Choose the bank to open

According to your needs, choose the bank to open the account, and list 2 factors that can be referred to

- Quantity: Number of service bases in the living area

- Distance: The nearest service bank from home

6.2 Queuing

After entering the lobby, you can usually tell the service staff directly that you want to open an account, or there will be a number plate machine, take the number plate, and wait for the staff to call the number.

6.3 Consultation and account opening

Usually there will be an exclusive Banker to take you to a special table and ask you about the business you need to serve this time. You just need to say that you want to open a Checking/ Saving Account. Select the type of account you want to open, and after confirming, you will start to enter your personal information.

- Document preparation: prepare the 4 documents I mentioned

- Debit Card pattern: Chase, BOA can be chosen

- Online Banking: By the way, set up online banking on site

- Mobile App: Set up the App at the same time

After opening an account, you will usually be given a folder with your

- routing number: Wire transfer code within the United States ( FAQs: Routing Numbers )

- checking account number

- saving account number

- swift code: overseas wire transfer code ( Wire Transfers FAQs )

Note: International wire transfer is required, so you must remember to ask the bank staff how you just made an international wire transfer from outside the United States to the United States.

7. Common Q&A

7.1 How to transfer living expenses into the United States

1. International Wire Transfer

2. Citibank® Global Transfers : Citibank® Global Transfers does not require handling fees, and enjoys free handling fees and instant remittances of a specific amount every day.

Read More: [Account Opening Teaching] Citibank Global Money Transfer, how to use Taiwan-US dollar remittance, easy to open an account in 3 steps

7.2 What materials do I need to prepare for international wire transfers?

Bank name and address

Swift code

Beneficiary Information

7.3 Do I have to have a U.S. phone number when applying for a U.S. bank account?

Not necessarily, but some guilds conduct SMS authentication. It is recommended to put a US phone number first.

7.4 Do I have to have a US address when applying for a bank account in the United States?

The bank will need a US address to send your Debit Card. Some banks allow overseas addresses. It is recommended that you call to inquire before applying.

Further reading: [U.S. Rental Housing] How to find a suitable place to live? 6 common steps to rent a house

7.5 What kind of bank account should I open if I want to invest in US stocks and ETFs?

You can open Firstrade is one of the very good US brokers. Many stocks and ETFs are free of transaction fees, and account opening does not require any account opening fees, and you can easily open an account online as long as it is online.

7.6 How do I start accumulating credit records when I first came to the United States?

You can start by applying for the first credit card. Although it has just landed and there is no SSN yet, there are a few Deserve Edu credit cards specially designed for international students. You can apply to accumulate credit records early.

Read More: [Study Abroad Credit Card] Deserve Edu credit card, no SSN, easy application in 3 steps

7.7 Is there any US bank recommended?

I personally think that it is enough to run a bank that is recommended by the local people and is convenient for withdrawals and work!

8. 2 useful US financial apps

8.1 US bank App (Zelle transfer)

For major bank apps, Zelle provides 30 banks across the United States to send money to your friends in real-time.

Zelle Transfer Limitation

| Daily Limitation | Monthly Limitation | |

| Chase | Chase Personal Checking: Max USD 2000/day Chase Business Checking/Private Client: Max USD 5000/day | Chase Personal Checking: Max USD 16,000/day Chase Business Checking/Private Client: Max USD 40,000/day |

| Bank of America | USD 2500/day | USD 20,000/Month |

| Citi Bank | Basic/Access: Max USD 2000/day Priority/Citigold/Private: Max USD 5000/day | Basic/Access: Max USD 2000/day Priority/Citigold/Private: Max USD 5000/day |

| Wells Fargo | USD 2500/day | USD 4000/Month |

8.2 Venmo

Venmo is an instant payment platform for petty cash. All the major banks mentioned above can be connected. Venmo is similar to a social platform and is considered a popular financial app in the United States.

More Study in the US Articles

- Study in the US strategy

- Overview of Study Abroad Strategy

- Save USD400 in one year Tips:

- US Telecom

- Preparation before departure:

- Rental House & Furniture:

- Credit card (cumulative credit history):

- Bank:

- U.S. brokerage:

- Tax filing:

- medical insurance:

- Car Rental & Driver’s License